March 16, 2020 is a day that any share market investor is likely to remember for a long time.

That’s the day that the Dow Jones Industrial Average, an index that tracks the top 30 companies listed on US stock exchanges, lost 2997 points, nearly 13 per cent of its value. That was a bigger one-day drop even than the big crash of October 1929.

Subscribe to Two Cents' Worth for free on Apple Podcasts, Spotify, Stitcher, RadioPublic or wherever you listen to your podcasts

Photo: 123RF

Since then, markets have remained volatile, though determined efforts internationally to “flatten the curve” plotting Covid-19 infections, and trillions of dollars in stimulus packages to prop up ailing economies, have given investors some hope that there is light at the end of the tunnel.

The big market swings from green into red and back have abated for the moment.

But for investors with wealth tied up in shares, it is a white-knuckled ride, especially for those who need to free up cash to make up for a drop in income. For those who have cash to spare or who have been sitting on the sidelines put off by the high share valuations resulting from the last decade’s bull run that peaked in February, it is also an opportunity to pick up shares at discounted rates.

Buying the dip

The three-year-old online share trading platform Sharesies normally receives 300 - 400 new registrations per day but through March has seen over 800 sign-ups each day as the market volatility sparks interest in share trading.

Sharesies co-founder Leighton Roberts says the big plunges in markets around the middle of March initially sparked some panicked selling among Sharesies users, but that it levelled out within a couple of days.

“The dip, when it happened, was very fast, we saw 10 per cent plus drops in single days. Most of the Sharesies investors deploy the dollar cost averaging investment strategy,” he says.

Dollar-cost averaging sees investors buy shares over a period of time rather than in a one-time purchase, taking advantage of downward moves in share prices. In a bear market, with share prices decreasing, it allows investors to buy shares on the way down instead of trying to pick the bottom of the dip.

Dollar-cost averaging could help make the most of a bad situation. Photo: 123rf

“That’s an extremely poor strategy to use if you only buy when markets are going up. The reason it is a good strategy is that you manage to buy when it is low as well,” says Roberts.

Sharesies was set up to make share trading easier and tapped into what Roberts saw as growing interest in share trading driven by two factors - low-interest rates on bank deposits and the overheated housing market locking out some prospective home buyers.

Share market investors looking long term now had an opportunity to apply dollar-cost averaging to their advantage.

“I’m confident over time these markets will recover and the people who continue to invest through these times will ultimately give themselves a pat on the back,” says Leighton.

Two Cents’ Worth talked to investors employing various strategies to get through the markets crisis.

Kirsty Merriman is currently under lockdown in Dunedin at the moment but is normally based with her husband in Doha, Qatar. Merriman is primarily a property developer and landlord and estimates around 15 per cent of her wealth is in shares.

Rate of infection is key

She bought some shares at discounted prices, mainly companies she was already an investor in and using funds she had accrued from previous dividend payouts. Every day she closely examines the charts plotting Covid-19’s rate of infection and mortality. The key to the outlook improving for share markets will be signs that governments worldwide have got the pandemic under control.

Investors are watching for signs the pandemic is under control. Photo: Xinhua / Xiao Yijiu / AFP

“We are in a position where we don’t know who has chosen the correct path. We’ve got shutdowns that are going to cause a lot of pain for some countries and some countries that have decided to cause a lot of health pain to avoid economic pain,” says Merriman.

“If that turns to custard I’m going to be very pleased that I didn’t throw everything in.”

A savvy investor who has profited from share market dips before, particularly post-2008 in the wake of the Global Financial Crisis, Merriman was taking a conservative approach, maintaining cash while watching closely for opportunities to get into undervalued companies.

“I have to share some of the pain with people who are living in my houses,” she says

“One lot had a baby and their jobs have been affected. So having cash means that I can keep us all going.”

The fundamentals of investing are more important than ever before, says Merriman and include close examination of a company’s financial accounts, P/E (price to earnings) ratio and consideration of how much debt a company has on its books.

Maxim Sherstobitov has been investing in shares since around 2013, contributing a small amount each month. He has seen an average annual return of 14 per cent, but recognises that his shareholdings are down 20 - 30 per cent following the big dips of late February and mid-March.

A conservative stance

Sherstobitov liquidated some of his shareholdings as markets fell, booking a loss of around ten per cent on February’s highs, but avoiding the worst of the declines markets have seen.

He isn’t looking for sharemarket bargains at the moment as he doesn’t anticipate the hoped-for V-shaped recover in the markets some analysts and economists are optimistically picking.

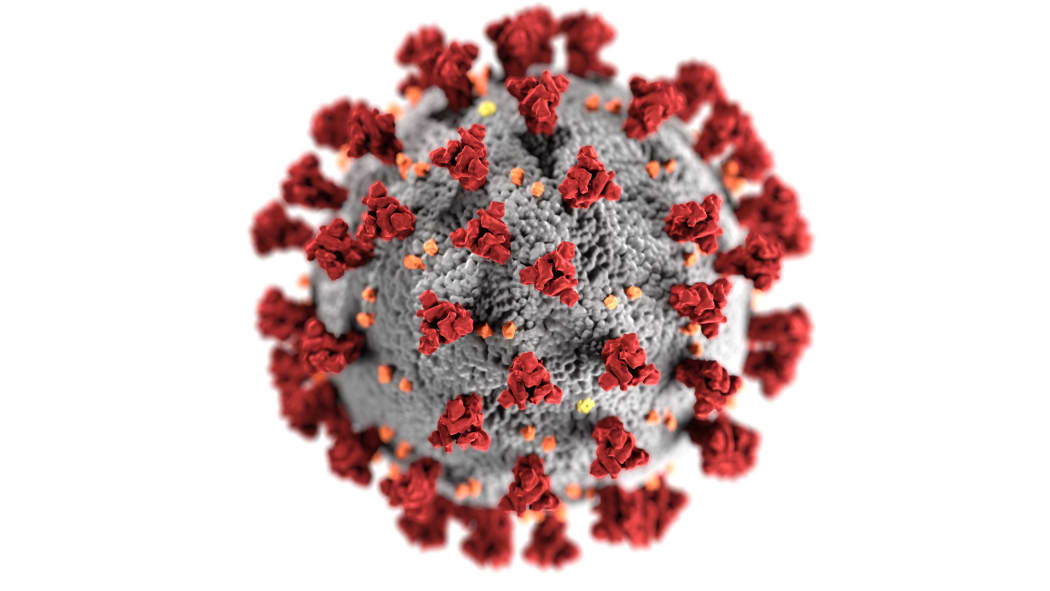

There's a chance markets could get worse before they get better. Photo: Alissa Eckert, MS, Dan Higgins, MAMS

Who is to say it is going to be a great discount now or a great discount in two months? I think there’s a big chance it could be even worse in two months. A lot of professional people say there could be a Depression. We could see unemployment rates in the United States or some other countries up to 20 or 30 per cent.”

Sherstobitov, who runs a small freight logistics company in Auckland that has been granted essential service status during the lockdown, is maintaining cash in case his business or his family back in Russia, need to draw on it.

Like Merriman, he carefully researches companies that he invests in and takes a long term view.

"I have a checklist I go through,” says Sherstobitov, who also runs the NZX Stock Market Investors forum on Facebook, which has over 2,000 members.

“One of the main things, it has to be a growth company, it has to be able to show a profit over the last four years and because I invest long term, over five to ten years, it has to have a big market to grow [in].”

Whatever the rule book investors followed, the uncertainty thrown up by Covid-19 means the markets are literally in uncharted territory with a pandemic driving the financial fortunes of people all over the world for the first time in over 100 years.