The nature of Sky TV’s new deal to secure premier rugby rights shows how far the under-pressure broadcaster was prepared to go to hold on to a key asset and it keeps online rivals at bay for now.

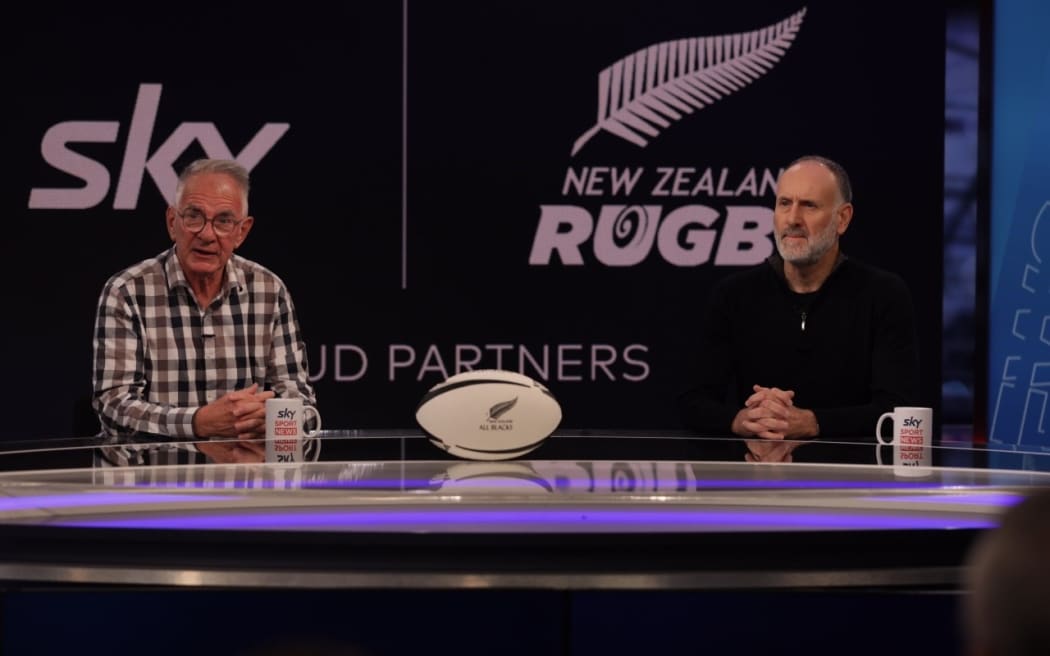

New Zealand Rugby chairman Brent Impey, left, and Sky NZ chief executive Martin Stewart Photo: RNZ / Cole Eastham-Farrelly

As expected, Sky TV has secured five more years of exclusive rights to screen the rugby competitions New Zealanders care about most - an asset that's been the cornerstone of its business for more than a quarter of a century.

But the structure of the deal was a surprise.

New Zealand Rugby (NZR) will take a 5 percent stake in Sky, an arrangement the pay TV provider described as “revolutionary”.

There are cases of media companies investing in sports franchises and clubs overseas or creating joint-ventures to broadcast their content - but taking an equity stake in a media partner seems to be a new tactic.

It’s also handy for the company which was valued at more than $2.5 billion just five years ago but is now worth just a fraction of that.

Last week Sky shares dipped below $1 for the first time since it listed on the NZX when Spark secured cricket broadcasting rights Sky had held since 1995.

That put the company’s market value below $400 million, the sum that several media reports claimed would be required to secure the critical rugby rights for five more years.

Giving up equity in the company means Sky will have to part with less up front, making the deal easier for shareholders to green-light at Thursday’s AGM.

The deal is a win for Sky’s recently-installed overseas chief executive Martin Stewart, seeking to take the company in a new direction while holding on to core subscribers who would have deserted in droves without the live rugby offering.

It also means Sky can continue to ration out selected premium sport, both live and delayed, on its free-to-air channel Prime TV which struggles to pull in big audiences with regular programming.

The extensive broadcasting experience of current NZR chairman Brent Impey, formerly long-serving chief executive at MediaWorks and its forerunner Canwest, will have been a significant factor in engineering the link between the two outfits.

When New Zealand Cricket decided to go with Spark Sport and TVNZ last week, its boss David White said “increased accessibility” of the sport to the public was a big factor. NZR has clearly been persuaded Sky will remain a solid partner that can deliver enough viewers, even as pundits proclaim it a sunset business whose days are numbered in the digital era.

Predictions that digital players would bypass broadcasters when the rights were on the market have proved premature.

In 2017 Sky TV and New Zealand Rugby struck a deal to offer live pay-per-view streams of the All Blacks and Māori All Blacks matches overseas on the NZ Rugby-owned website AllBlacksTV.com.

That prompted some pundits to predict that the NZR could launch their own online channel and offer ‘fan pass’-style coverage of their own direct to viewers.

Amazon Prime’s big bids for sports rights overseas, such as ATP tennis and EPL football, prompted speculation that it or another big global digital player would make NZR and SANZAAR an offer they couldn’t refuse out of their spare change.

But the closest Amazon Prime got was making a documentary series about the All Blacks called All or Nothing for its streaming service.

In the end, Sky has responded to the fear of ending up with nothing by going all-in and offering a part of itself to its partner to seal the deal.