A new report has revealed the country's wealthiest are paying a median effective tax rate of 9.5 percent, including GST Photo: RNZ

Analysis - If nothing else, the just released Inland Revenue study of the tax rates paid by the wealthiest New Zealanders should put to rest the notion we have a progressive tax system. We don't.

A progressive system is one where higher earners pay more as their income grows. The report, commissioned by Minister of Revenue and Attorney-General David Parker, has revealed the country's wealthiest are paying a median effective tax rate of 9.5 percent (including GST).

This is less than half the tax paid by middle income earners at 22 percent, or nearly 30 percent if you include GST. But while many commentators have asked how such a low tax rate is possible, the real question should be what happens next?

Will the government change the tax code to include a robust capital gains tax? In a hotly contested election year, is there much political will to target the core source of income for New Zealand's richest people?

Whatever the answers, we should first recognise just how important this report is. The now decommissioned Tax Working Group, of which I was a member, called for this study to be completed. It is satisfying to see the country now has better information on which to base its tax decisions.

The now decommissioned Tax Working Group called for the IRD tax study on the wealthiest people to be completed. Photo: RNZ / Richard Tindiller

New Zealand's one percent

Inland Revenue surveyed the incomes of 311 households since 2021 for its study. The average net wealth of each household was NZ$276 million and collectively this group owns about $85 billion worth of assets.

Another way to describe this is that the richest 1 percent owns about a quarter of the country's financial assets.

According to Inland Revenue, those surveyed are meeting all their income tax obligations. There was no evidence of any wrongdoing.

But only 7 percent of their overall economic income is taxed in their personal name. The other 93 percent comes from investment returns, most of which would be untaxed. These households also use entities, trusts and companies, which are taxed at a lower rate than individuals.

Based on the fact that 93 percent of the increase in their wealth is from an untaxable source, it's no wonder they pay tax at such a low rate. In fact it's surprising they are paying as much tax as they are.

Big change unlikely

Thanks to the information contained in Inland Revenue's study, our unease over how we tax people (and whether the system is truly progressive) is more than just a feeling. The report provides hard, factual information illustrating the consequences of current tax policy.

On Thursday, Prime Minister Chris Hipkins ruled out a capital gains or wealth tax from the 18 May Budget. Photo: RNZ / Angus Dreaver

Ahead of the report's release, however, Prime Minister Chris Hipkins refused to be drawn on Labour's tax policy and whether there would be any changes. Revenue Minister Parker only hinted at possible tweaks.

With a budget and an election on the horizon, it is unlikely this government will be making significant changes to the tax code. In the current political environment, it is very difficult to persuade a majority that new taxes are a good idea.

But it is quite possible there may be a tax reduction for lower and middle income earners, combined with additional taxation on capital in some way.

Who pays the bills?

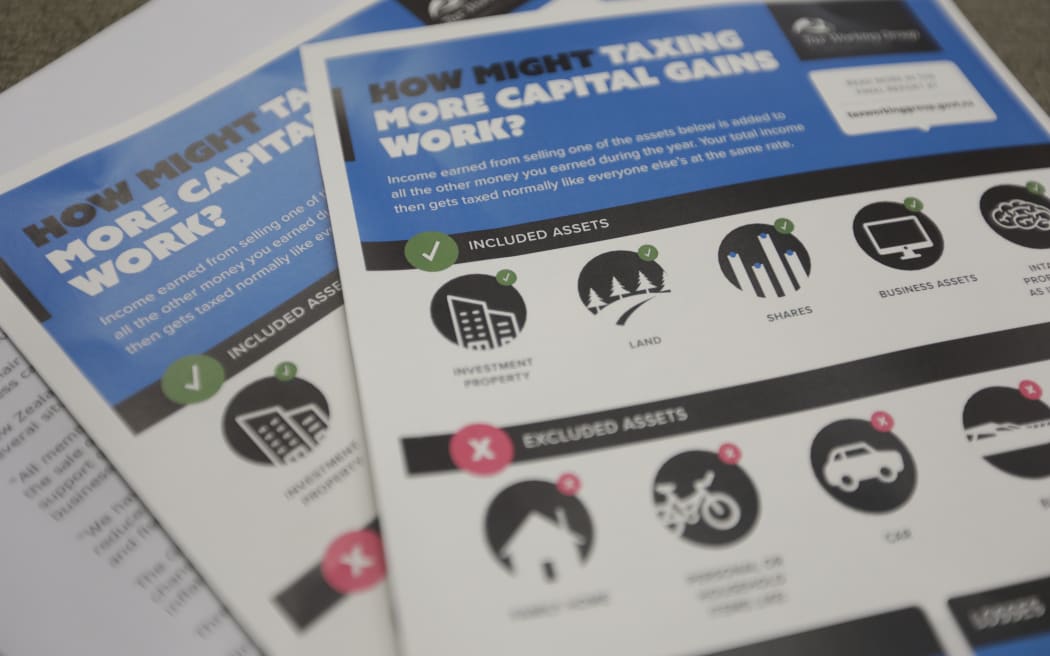

Pictured is documents from previous years when the capital gains tax was being proposed, but Craig Elliffe says it's unlikely something like that will be planned again. Photo: RNZ / Rebekah Parsons-King

Despite it being an obvious target, however, we should not expect a robust capital gains tax. The previous Labour government ruled this out and it is unlikely to gain traction now.

With just six months until the general election, too, there isn't time for the requisite legislation to be written and consulted on.

Most New Zealanders do not really need to think about tax at all - more than half do not even file tax returns. But even this group should benefit from being aware of the Inland Revenue findings and be better informed during the subsequent debates on tax policy.

Because behind all these questions about who pays what tax rate lie significant considerations. New Zealand's infrastructure spending is increasing and many social services need greater investment. How we pay for it will determine whether we keep up or fall behind.

How much money the government earns from taxation, who pays and how much they pay is a political conversation we cannot put off forever.

* Craig Elliffe is a professor of law at the University of Auckland.

**Disclosure statement: Elliffe was an independent reviewer of the IRD high-wealth individuals research project report.