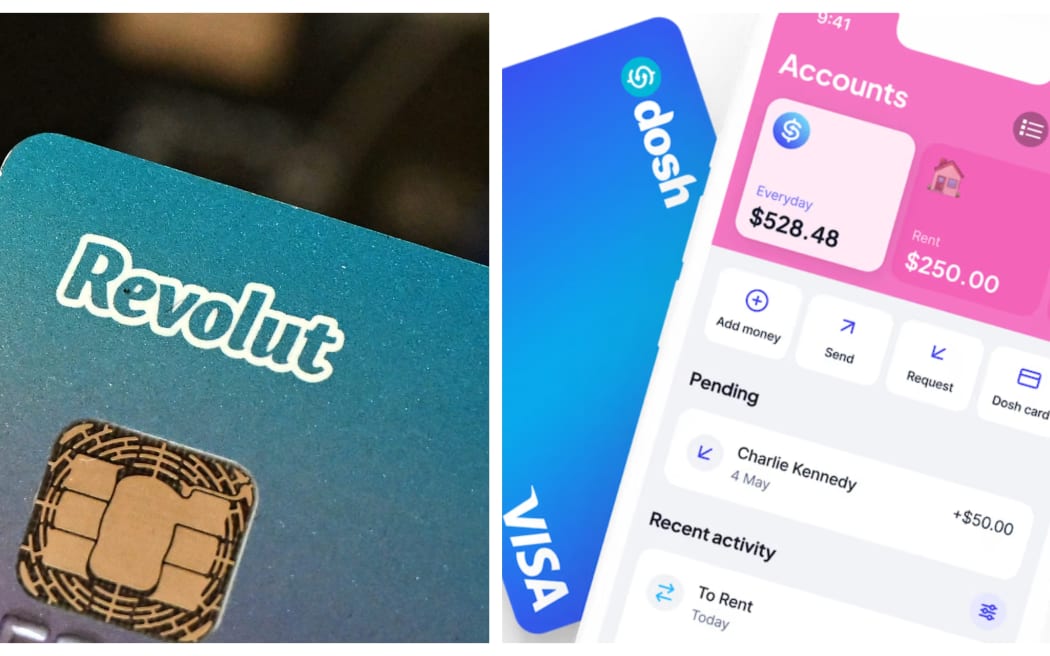

Some fintechs say they can be the "maverick" disruptor New Zealand's banking system is missing. These are digital services that offer more innovation when it comes to things like budgeting data, foreign exchange and transferring money. But the Commerce Commission says these fintechs are struggling to get a foothold here citing issues around data access, obtaining a business bank account and scaling difficulties. Revolut started in the UK in 2015 as a pre-paid card with no transaction fees and it has now expanded to offer wider banking services. Popular with New Zealand expats in London, it arrived here last July and has more than 30 million customers worldwide. DOSH is a New Zealand fintech that offers a digital wallet making it easy to split a bill or cap spending on certain things. Neither are registered banks but they are both financial services providers. Georgia Grange is Revolut's New Zealand head, and Shane Marsh is co-founder of DOSH. Kathryn also speaks to banking expert and Massey University associate professor Claire Matthews.

Photo: Supplied by Revolut and DOSH