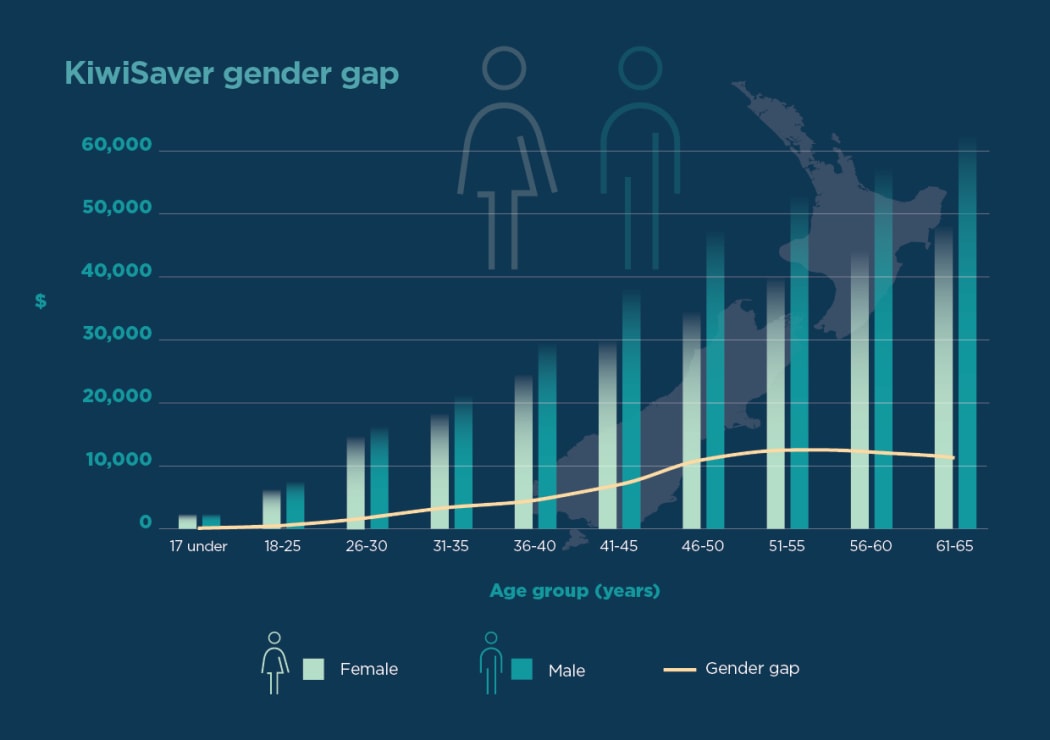

The KiwiSaver gender gap Photo: Supplied

Concerning differences between the KiwiSaver contributions of men and women have been exposed in new research from Te Ara Ahunga Ora The Retirement Commission.

The report revealed a 36 percent gap between the amount men and women are putting into KiwiSaver each year.

Te Ara Ahunga Ora policy lead Dr Michelle Reyers said KiwiSaver balance inequalities were outpacing the actual gender pay gap.

She said men and women are contributing the same percentage of their salaries, but women were disadvantaged by working part-time and taking greater care responsibilities, which were unpaid.

"We're seeing the impact of women being in part-time rather than full-time positions, and all of that is really contributing to the gap being a lot bigger than the hourly rate of 9 percent," she said.

The research also highlighted ethnic pay gaps which saw lower KiwiSaver contribution amounts for Māori and Pacific peoples.

"If you are Māori or Pacific, you are likely to have around $1500 less contributed into your KiwiSaver account annually than a European person," she said.

However, Māori have the second highest average employee contribution rate of the ethnic groups reported in this research, despite having the lowest average income.

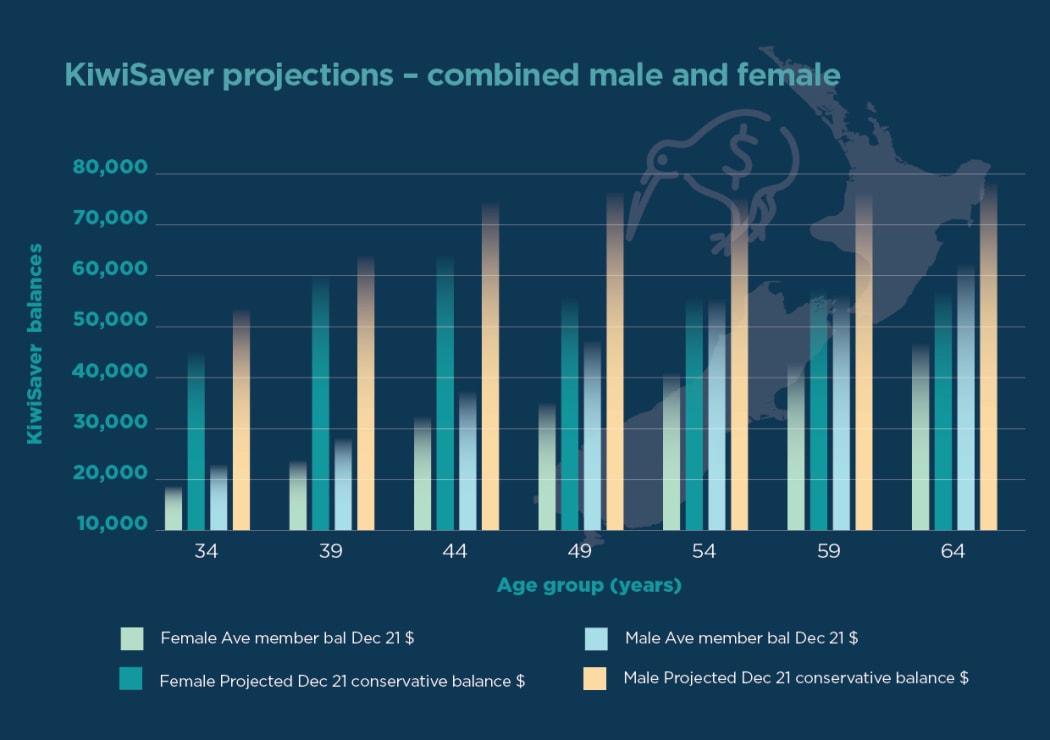

Te Ara Ahunga Ora Retirement Commission's projections of retirement savings for men and women demonstrates the gender pension gap in retirement savings and retirement savings projections by age 65. Photo: Supplied

The data highlighted the sizeable impact of ethnic and gender pay gaps on New Zealanders' abilities to prepare adequately for retirement.

It is already known that Māori, Pacific Peoples and women are more likely to be reliant on NZ Super in retirement due to lower savings and investments.

Retirement Commissioner Jane Wrightson is calling on employers to take a careful look at their current KiwiSaver policies and whether they have their employees' best interests at heart.

"At the moment we're not seeing employers show the initiative we'd hope to see," Jane Wrightson said.

"One in three employees already contribute at a rate higher than the 3 percent minimum. Unfortunately, less than 10 percent of employers contribute more than the compulsory 3 percent, and almost half include KiwiSaver contributions in total earnings for some or all of their employees, which can disincentivise employees to contribute.

"If we want to see change, I think we need to see a more proactive attitude across the board from employers. We all have a stake in New Zealand's future and there are concerns that people may not be saving enough for retirement, so we need to be taking practical steps to tackle these issues."

Reyers said it was pleasing to see the Australian government taking steps to address the retirement savings gap for women.

She hoped similar measures could be introduced on this side of the Tasman to support women on paid parental leave by paying superannuation on the paid leave.